You forecast that the next project will take a month and make you £10k of profit. But when you go to look in the bank at the end of the month you see a different number. Why does this happen?

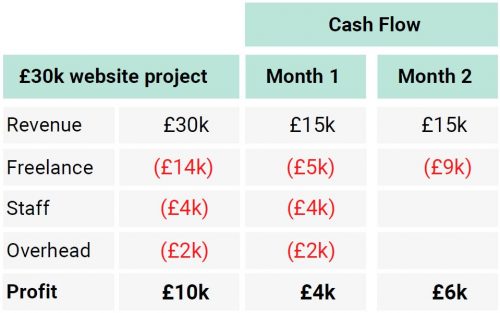

Let’s start by defining what profit is. Simply put, profit is what you have left when you deduct your costs from your revenue. Let’s consider an example:

So why would you not see £10k in the bank at the end of the month? The main cause will be timing differences. The project takes 1 month to complete but the cash inflows and outflows happen over two months as shown in the table below:

The project has been billed in two invoices, first 50% at the start and second 50% on completion. This means you receive £15k in month 1 and £15k in month 2, rather than all £30k in month 1.

You work with two different freelancers. One of them is organised and invoices you £5k in month 1 which you pay. The other doesn’t invoice you until after the project has finished so you have to pay another £9k in month 2.

Your staff and overhead costs allocated to the project get paid as normal in month 1.

The overall impact is that at the end of Month 1 when the project is finished, we have a profit of £10k but we only have £4k cash in the bank. The remaining £6k doesn’t come into the bank until month 2.

If you run a growing creative business and the thought of managing your cash flow breaks you out in a cold sweat, then give us a call to see how we can help, leaving you to focus on being creative.